In recent years, the market for gold coins has experienced a significant resurgence, driven by a combination of factors including economic uncertainty, inflation concerns, and an increasing interest in precious metals as a form of investment. As a result, collectors, investors, and enthusiasts alike are finding a wealth of options available for purchase, each offering its own unique history, design, and potential for buy gold coins value appreciation. This article delves into the current landscape of gold coins for sale, highlighting key trends, popular choices, and tips for navigating this fascinating market.

The Appeal of Gold Coins

Gold coins have been used as currency for centuries, and their intrinsic value has made them a coveted asset throughout history. Unlike paper currency, which can be printed at will, gold is a finite resource, and its value is often seen as a hedge against inflation and economic instability. In times of financial uncertainty, investors often turn to gold as a safe haven, leading to increased demand for gold coins.

Types of Gold Coins Available

The market for gold coins is diverse, with various types and styles available for collectors and investors. Here are some of the most popular categories:

- Bullion Coins: These are coins that are primarily valued based on their gold content rather than their numismatic value. Examples include the American Gold Eagle, Canadian Gold Maple Leaf, and South African Krugerrand. Bullion coins are typically sold at a premium over the spot price of gold, but they are widely recognized and easily tradable.

- Numismatic Coins: These coins hold value beyond just their gold content due to their rarity, age, or historical significance. Examples include ancient gold coins, such as those from the Roman Empire, and more modern collectible coins. Numismatic coins can command much higher prices than their bullion counterparts, making them attractive to collectors.

- Commemorative Coins: Minted to celebrate specific events or anniversaries, commemorative gold coins often feature unique designs and limited mintage. While they may have a higher premium, their collectible nature can lead to significant appreciation in value over time.

- Gold Coin Sets: Many mints offer sets of gold coins, which can include various denominations or designs. These sets can be particularly appealing to collectors looking to acquire a complete series or those interested in gifting unique items.

Current Market Trends

The gold coin market is influenced by several key trends that are shaping the buying and selling landscape:

- Increased Demand: The ongoing economic uncertainty, coupled with rising inflation rates, has led to a surge in demand for gold coins. Investors are seeking to diversify their portfolios and safeguard their wealth, resulting in higher sales for both bullion and numismatic coins.

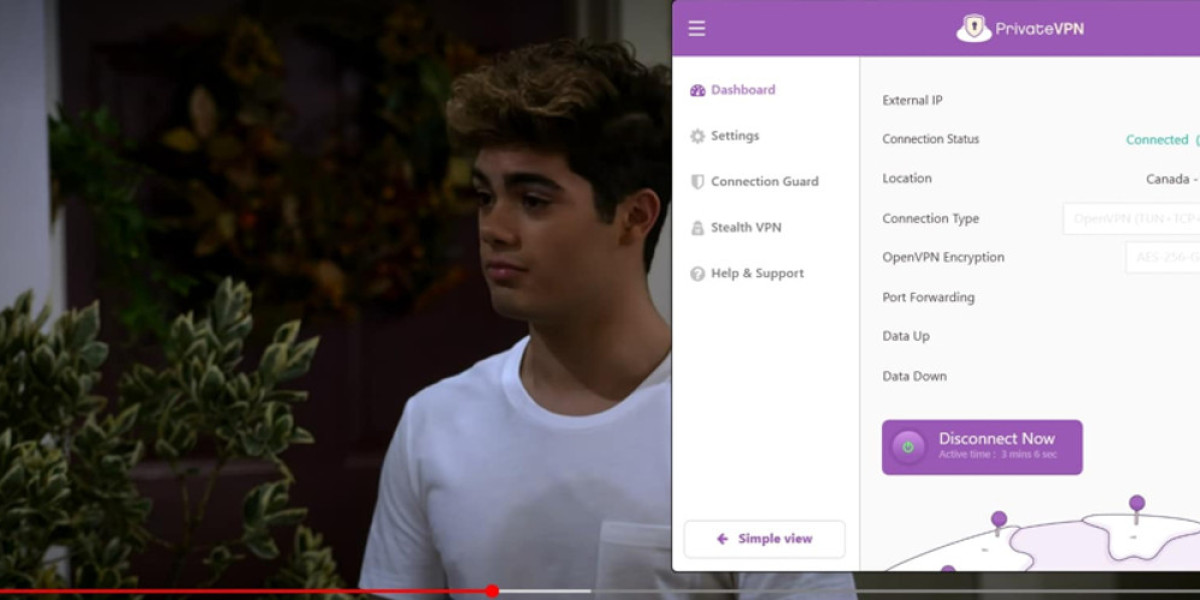

- Online Sales Platforms: The rise of e-commerce has made it easier than ever to buy gold coins. Numerous reputable online dealers now offer a wide variety of coins, often with detailed descriptions and transparent pricing. This accessibility has attracted new buyers who may not have previously considered investing in gold.

- Investment in Quality: Collectors and investors are increasingly focused on the quality and condition of the coins they purchase. Coins graded by professional grading services, such as the Professional Coin Grading Service (PCGS) or Numismatic Guaranty Corporation (NGC), tend to fetch higher prices and are more sought after in the market.

- Sustainability Concerns: As environmental awareness grows, some buyers are expressing interest in ethically sourced gold. This trend has led to discussions about responsible mining practices and the impact of gold mining on the environment, influencing purchasing decisions for some investors.

Popular Gold Coins for Sale

When exploring the current offerings in the gold coin market, several coins stand out due to their popularity, historical significance, and investment potential:

- American Gold Eagle: One of the most recognized gold coins in the world, the American Gold Eagle is produced by the United States Mint and contains one ounce of pure gold. Its iconic design features Lady Liberty on the obverse and a family of eagles on the reverse. The coin is available in various denominations, making it accessible to a wide range of investors.

- Canadian Gold Maple Leaf: Known for its purity, the Canadian Gold Maple Leaf is made from 99.99% pure gold and is celebrated for its stunning design featuring the iconic maple leaf. It is a popular choice among investors and collectors alike.

- South African Krugerrand: The first gold bullion coin ever minted, the Krugerrand has a rich history and is highly sought after by investors. It is made of 22-karat gold and features a profile of Paul Kruger on the obverse.

- British Gold Sovereign: This historic coin has been minted since the 15th century and remains a popular choice among collectors. The Gold Sovereign features a design of St. George and the Dragon, symbolizing British heritage.

- Chinese Gold Panda: Known for its unique designs that change annually, the Chinese Gold Panda is a favorite among collectors. It features a panda on the reverse and is available in various weights, making it an attractive option for both collectors and investors.

Tips for Buying Gold Coins

Navigating the gold coin market can be overwhelming, especially for newcomers. Here are some tips to consider when purchasing gold coins:

- Research Reputable Dealers: Always buy from established and reputable dealers who provide transparent pricing and detailed descriptions of their products. Look for dealers with positive reviews and industry certifications.

- Understand buy gold coins Grading: Familiarize yourself with coin grading and buy gold coins the significance of condition. Coins that are graded by professional services can command higher prices, so understanding this aspect can help you make informed purchasing decisions.

- Stay Informed: Keep up with market trends and gold prices. Understanding the factors that influence gold prices can help you time your purchases and maximize your investment potential.

- Consider Storage and Insurance: If you are investing in gold coins, consider how you will store and protect them. Secure storage options, such as a safe deposit box or a home safe, are essential. Additionally, consider insuring your collection to safeguard against loss or theft.

- Diversify Your Collection: If you are a collector, consider diversifying your collection by acquiring coins from different categories, such as bullion, numismatic, and commemorative coins. This approach can enhance the overall value and enjoyment of your collection.

Conclusion

The current market for gold coins offers a fascinating array of options for collectors and investors alike. With increased demand, the rise of online sales platforms, buy gold coins and a focus on quality and sustainability, this market is evolving rapidly. Whether you are looking to invest in bullion coins, explore numismatic treasures, or acquire unique commemorative pieces, the world of gold coins is rich with opportunities. By staying informed and making educated purchasing decisions, you can navigate this treasure trove and potentially reap the rewards of your investment in gold coins.