Applying for an IPO is exciting—but the real suspense begins when investors start checking the IPO status of allotment. Whether you’re a first-time investor or a regular IPO applicant, understanding the allotment process can save you confusion and stress.

In this guide, we’ll walk you through the entire IPO journey, explain how IPO allotment status check online works, and show you how platforms like ipowatch make tracking easy.

What Is IPO Allotment Status?

The allotment status of IPO tells you whether shares have been allotted to your demat account or not. Since most IPOs are oversubscribed, not every applicant receives shares.

In simple words:

Allotted → Shares credited

Not allotted → Money refunded

Why IPO Allotment Status Is Important

Checking IPO allotment status helps investors:

Confirm share allocation

Track refund timelines

Plan listing-day strategy

Avoid unnecessary panic

It’s the bridge between application and listing day.

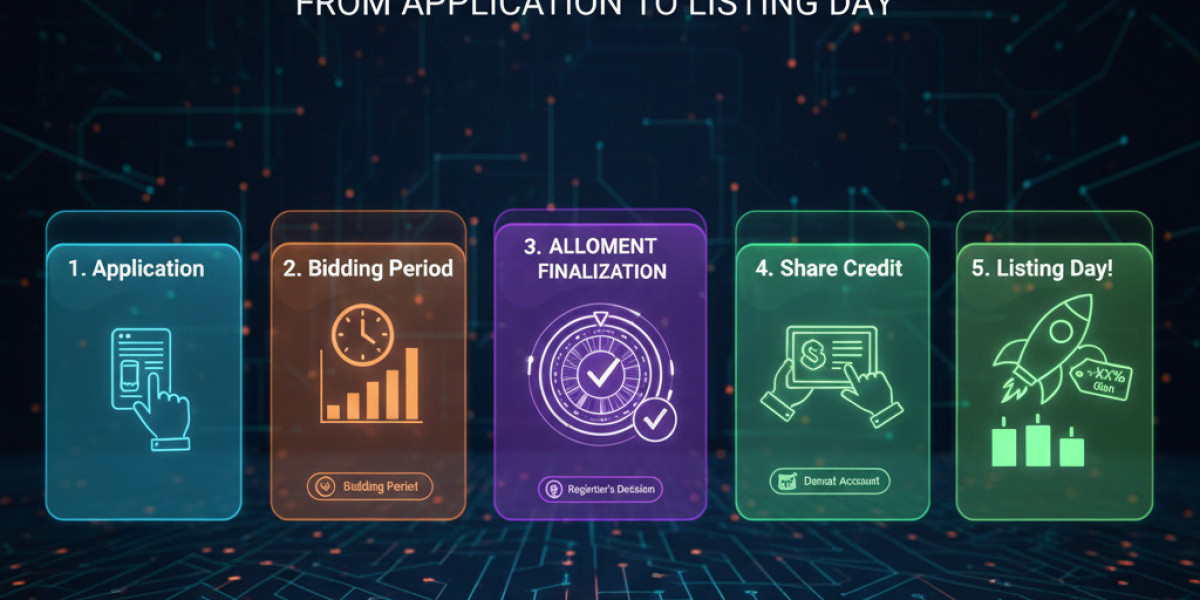

IPO Journey: From Application to Listing

1. IPO Application Stage

You apply for an IPO using:

UPI-based ASBA

Net banking

Broker platforms

Funds are blocked, not deducted.

2. Subscription & Bidding Process

IPO subscriptions are divided into:

Retail Investors (RII)

Qualified Institutional Buyers (QIB)

Non-Institutional Investors (NII)

Oversubscription plays a major role in allotment probability.

What Happens During IPO Allotment?

Meaning of Allotment Status of IPO

After the IPO closes, the registrar finalizes the basis of allotment, ensuring fair distribution as per SEBI rules.

Who Decides IPO Allotment?

The IPO registrar (like KFintech or Link Intime) handles the allotment process, not the stock exchange or company.

How to Check IPO Allotment Status Online

IPO Allotment Status Check on IPOWatch

ipowatch is one of the most popular platforms where investors can:

Check IPO allotment status updates

View allotment dates

Access registrar links

Track listing performance

It acts as a one-stop IPO information hub.

IPO Allotment Status Check Online via Registrar

You can also check allotment status directly on the registrar’s website using:

PAN number

Application number

DP/Client ID

Using PAN for IPO Allotment Status

PAN-based search is the most reliable and widely used method.

Important IPO Allotment Dates Explained

Basis of Allotment Date

This is when the registrar finalizes who gets shares.

Refund & Share Credit Date

If not allotted → funds unblocked

If allotted → shares credited to demat

IPO Listing Day

The stock finally lists on NSE/BSE, and trading begins.

Possible IPO Allotment Outcomes

If Shares Are Allotted

Shares appear in demat account

You can sell on listing day or hold

If Shares Are Not Allotted

Funds are released automatically

You can apply for the next IPO

No manual action is required.

Why Investors Don’t Get IPO Allotment

Oversubscription

When demand exceeds supply, allotment becomes lottery-based for retail investors.

Technical Issues

UPI mandate failure

Incorrect PAN or demat details

Late application

Tips to Improve IPO Allotment Chances

Apply early, not at the last minute

Avoid multiple bids from the same PAN

Ensure correct bank and demat linkage

Focus on IPOs with reasonable valuations

IPO Allotment Status vs Listing Performance

Getting allotment doesn’t guarantee profit. Some IPOs list below issue price despite strong demand.

Always consider:

Company fundamentals

Market condition

Grey market trends (carefully)

The IPO status of allotment is a crucial step in your IPO investment journey. By understanding the process and using trusted platforms like IPOwatch for IPO allotment status check online, investors can stay informed and confident.

IPO investing isn’t just about luck—it’s about knowledge, timing, and patience.