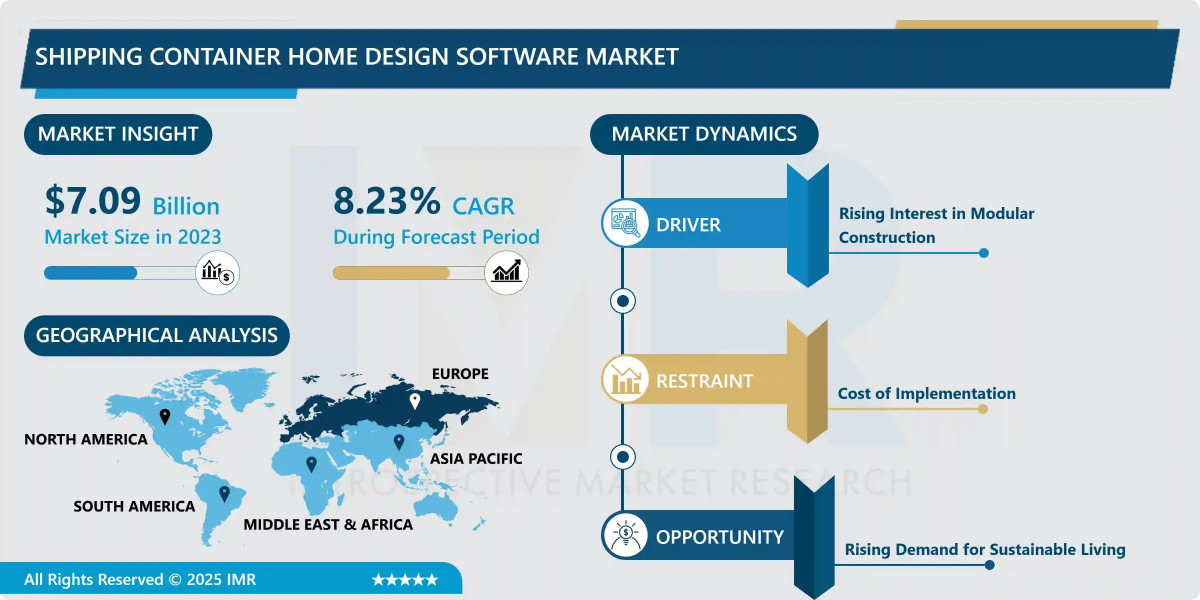

According to a new report published by Introspective Market Research, Shipping Container Home Design Software Market by Deployment, End-User, Application, and Region, The Global Shipping Container Home Design Software Market Size Was Valued at USD 7.09 Billion in 2023 and is Projected to Reach USD 14.45 Billion by 2032, Growing at a CAGR of 8.23%.

Market Overview:

The global Shipping Container Home Design Software market encompasses specialized digital tools and platforms used to plan, design, visualize, and engineer residential and commercial structures built from repurposed shipping containers. This software includes features for 3D modeling, structural analysis, material take-offs, and integration with modular construction workflows. Compared to traditional architectural software or manual drafting, these specialized solutions offer distinct advantages: pre-built libraries of standardized container modules, automated calculations for structural modifications (like cutting and welding), tools for optimizing space within rigid dimensions, and realistic visualization of sustainable and industrial aesthetics unique to container architecture.

This software is essential for architects, designers, builders, and DIY enthusiasts driving the sustainable housing and modular construction movements. Its main applications include creating detailed architectural plans, generating photorealistic renderings for client presentations, producing precise fabrication and assembly instructions, and ensuring building code compliance for unconventional structures. The market's growth is propelled by the rising global popularity of shipping container homes due to their affordability, sustainability, durability, and modern appeal. This trend, coupled with advancements in software usability—such as drag-and-drop interfaces and cloud-based collaboration—is making sophisticated design accessible to professionals and enthusiasts alike, fueling demand for purpose-built tools that streamline the unique challenges of container-based construction.

Growth Driver:

The primary growth driver for this market is the surge in global demand for affordable, sustainable, and rapidly deployable housing solutions, with shipping container homes emerging as a leading alternative. Amidst rising construction costs, material shortages, and a growing emphasis on circular economy principles, repurposed shipping containers offer a cost-effective, durable, and eco-friendly building block. This boom in container architecture creates a direct need for software that can efficiently handle its specific design constraints—such as standard dimensions, structural integrity post-modification, and thermal insulation planning. The software market grows in lockstep with the construction trend, as both professionals and DIY adopters seek tools to reduce design errors, optimize material use, visualize outcomes, and streamline project approvals, making specialized software a critical enabler of the entire container home ecosystem.

Market Opportunity:

A significant and high-growth opportunity lies in the development of integrated end-to-end platforms that combine design, sourcing, project management, and regulatory compliance. Future software can evolve beyond pure design tools into comprehensive ecosystems. This includes features like direct integration with container supplier inventories, automated generation of bill of materials (BOM) and cost estimates, connection to marketplaces for prefabricated container modules (like kitchens, bathrooms), and built-in checklists for local building codes and permit requirements. Furthermore, incorporating augmented reality (AR) for on-site visualization and virtual reality (VR) for immersive client walkthroughs can create a premium, value-added service tier. This shift from a design tool to a central project management hub would capture greater customer lifetime value and become indispensable for serious builders and developers.

Shipping Container Home Design Software Market, Segmentation

The Shipping Container Home Design Software Market is segmented on the basis of Deployment, End-User, and Application.

Deployment

The Deployment segment is further classified into Cloud-Based and On-Premise. Among these, the Cloud-Based sub-segment accounted for the highest market share in 2023. Cloud deployment dominates due to its accessibility, lower upfront cost (via subscription models), and superior collaboration features. Architects, contractors, and clients can access, review, and modify designs from any location, which is crucial for distributed teams and remote project management. Automatic updates, scalable computing power for rendering, and reduced need for high-end local hardware make cloud-based solutions the preferred choice for firms of all sizes, driving widespread adoption and recurring revenue for software providers.

End-User

The End-User segment is further classified into Architects & Designers, Builders & Contractors, DIY Enthusiasts, and Real Estate Developers. Among these, the Architects & Designers sub-segment accounted for the highest market share in 2023. This group represents the primary professional users who require advanced, precision tools for creating compliant, buildable, and innovative container home designs. They leverage the software’s full capabilities for 3D modeling, technical drawing, structural analysis, and client presentations. As the key specifiers and creative drivers behind most commercial and high-end residential container projects, their demand for powerful, professional-grade software establishes this segment as the largest and most influential in the market.

Some of The Leading/Active Market Players Are-

• Autodesk, Inc. (USA)

• Trimble Inc. (USA)

• Dassault Systèmes (France)

• Bentley Systems, Incorporated (USA)

• Graphisoft SE (Hungary)

• Chief Architect, Inc. (USA)

• Vectorworks, Inc. (USA)

• SketchUp (Trimble) (USA)

• SoftPlan Systems, Inc. (USA)

• Cadsoft Corporation (USA)

• ActCAD LLC (India)

• SolidWorks (Dassault Systèmes) (France)

• Bricsys NV (Belgium)

• Asuni (Spain)

• Container Home Plans Software (Niche Providers)

• and other active players.

Key Industry Developments

News 1:

In March 2024, Autodesk announced new AI-powered features within its Architecture, Engineering & Construction (AEC) Collection specifically optimized for modular and container-based design. The tools automate clash detection for MEP (mechanical, electrical, plumbing) systems within confined container spaces and suggest optimal structural reinforcement layouts, significantly speeding up the design process for complex projects.

News 2:

In January 2024, SketchUp launched a dedicated "Sustainable Construction" extension pack featuring an extensive library of pre-modeled shipping container assets and automated tools for calculating recycled material content and embodied carbon. This directly caters to architects needing to meet sustainability certifications and report on the environmental benefits of their container home designs.

Key Findings of the Study

• Cloud-Based deployment dominates, favored for its accessibility, collaboration, and cost-effectiveness.

• Architects & Designers are the leading end-user segment, driving demand for professional-grade tools.

• The global rise in affordable, sustainable housing using shipping containers is the key growth driver.

• A major trend is software evolution into integrated platforms offering design, sourcing, cost estimation, and compliance management in a single ecosystem.