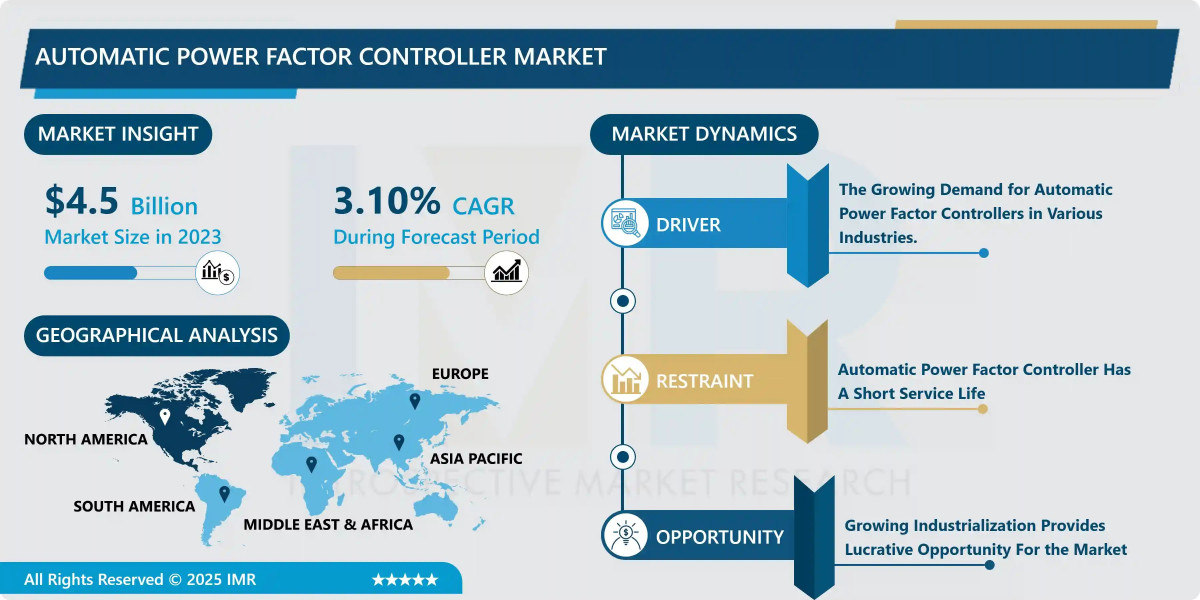

According to a new report published by Introspective Market Research, Automatic Power Factor Controller Market by Type, Application, End-User, and Region, The Global Automatic Power Factor Controller Market Size Was Valued at USD 4.5 Billion in 2023 and is Projected to Reach USD 5.92 Billion by 2032, Growing at a CAGR of 3.10%.

Market Overview:

The global Automatic Power Factor Controller (APFC) market consists of intelligent electronic devices and panels designed to automatically monitor and improve the power factor of an electrical system. These systems work by switching capacitor banks in and out of the circuit in real-time to compensate for reactive power, thereby optimizing electrical efficiency. Compared to traditional fixed capacitor banks or manual correction methods, APFC systems offer significant advantages: they provide dynamic, precise correction that adapts to fluctuating loads, prevent over-correction or under-correction, enhance the lifespan of equipment, and eliminate costly penalties from utility providers for poor power factor.

APFC panels are essential across major industries with substantial inductive loads. Their primary use is in industrial and commercial facilities such as manufacturing plants, steel mills, chemical processing units, data centers, hospitals, and large commercial complexes. By maintaining a power factor close to unity, these systems reduce overall current draw, minimize transmission losses, increase the effective capacity of existing electrical infrastructure, and lead to substantial savings on electricity bills. The market's steady growth is underpinned by the global imperative for energy efficiency, stringent regulations on industrial energy consumption, and the ongoing modernization of aging electrical infrastructure worldwide, making APFC a critical investment for cost-conscious and sustainability-focused enterprises.

Growth Driver:

The foremost driver for the APFC market is the escalating global focus on energy efficiency and the consequent need to reduce operational electricity costs and carbon footprint. Industrial and commercial facilities are under immense financial pressure from rising energy tariffs and, in many regions, stringent regulatory mandates to improve energy performance. Poor power factor results in inefficient energy use, leading to higher demand charges and power losses. APFC systems offer a proven and rapid return on investment (ROI) by significantly lowering electricity bills, avoiding utility penalties, and qualifying for energy efficiency incentives. This direct economic benefit, coupled with corporate sustainability goals, is compelling facility managers and energy auditors to mandate APFC installations as a standard energy conservation measure.

Market Opportunity:

A significant emerging opportunity lies in the integration of APFC systems with Industrial Internet of Things (IIoT) platforms and smart grid infrastructure. Next-generation APFC controllers are evolving into connected devices that provide real-time data on power quality, energy consumption, and capacitor bank health. This data can be integrated with broader building management systems (BMS) or energy management systems (EMS) for centralized monitoring, predictive maintenance, and advanced analytics. Furthermore, in smart grid scenarios, utilities can leverage aggregated APFC data for better demand-side management. This transformation from a standalone correction device to a smart, data-generating node within a digital energy ecosystem creates value-added services, enabling remote diagnostics, performance benchmarking, and optimized energy procurement strategies.

Automatic Power Factor Controller Market, Segmentation

The Automatic Power Factor Controller Market is segmented on the basis of Type, Application, and End-User.

Application

The Application segment is further classified into Industrial, Commercial, and Residential. Among these, the Industrial sub-segment accounted for the highest market share in 2023. This dominance is attributed to the high concentration of inductive loads—such as large motors, transformers, and welding machines—in manufacturing, metal processing, and heavy industries. These loads cause significant lagging power factor, leading to substantial inefficiencies and penalty charges. The scale of energy consumption in industrial facilities makes the cost savings from APFC installations most pronounced, driving widespread adoption as a fundamental component of plant electrical systems to enhance operational efficiency and reduce overhead costs.

Type

The Type segment is further classified into Low Voltage APFC and High Voltage APFC. Among these, the Low Voltage APFC sub-segment accounted for the highest market share in 2023. Low voltage systems (typically up to 690V) are the most prevalent due to their application in the vast majority of commercial buildings, factories, and infrastructure projects where electrical distribution occurs at lower voltages. They are easier to install, require less space, and are more cost-effective for a wide range of end-users. The proliferation of low-voltage electrical networks across expanding industrial and commercial sectors globally ensures the continued dominance of this product type.

Some of The Leading/Active Market Players Are-

• ABB Ltd. (Switzerland)

• Schneider Electric SE (France)

• Eaton Corporation plc (Ireland)

• Siemens AG (Germany)

• General Electric Company (USA)

• Larsen & Toubro Limited (India)

• Legrand S.A. (France)

• Mitsubishi Electric Corporation (Japan)

• Toshiba Corporation (Japan)

• CG Power and Industrial Solutions Ltd. (India)

• Socomec Group (France)

• Vertiv Holdings Co. (USA)

• NOVAR GmbH (Germany)

• Circutor, S.A. (Spain)

• RTR Energía (Spain)

• and other active players.

Key Industry Developments

News 1:

In February 2024, Schneider Electric launched the next generation of its EcoStruxure Power Factor Correction solution with embedded cloud connectivity. This enables facility managers to monitor power quality and APFC performance remotely via a digital dashboard, facilitating predictive maintenance and optimizing energy savings across multiple sites from a centralized platform.

News 2:

In October 2023, ABB announced a strategic partnership with a major data center operator to deploy AI-enhanced APFC panels. These systems use machine learning algorithms to predict load patterns and pre-emptively adjust capacitance, achieving superior power factor correction and further reducing energy losses in highly dynamic IT load environments.

Key Findings of the Study

• The Industrial application segment dominates, driven by high inductive loads and significant cost-saving potential.

• Asia-Pacific is the leading regional market, fueled by rapid industrialization and infrastructure development.

• The global push for energy efficiency and reduction in electricity costs is the primary growth driver.

• A key trend is the integration of IIoT and cloud connectivity for remote monitoring, data analytics, and predictive maintenance of APFC systems.